Bank of America's top 10 trades for 2023

Bank of America's top 10 trades for 2023

Next year the U.S. will experience a mild recession with the fed funds rate peaking at 5.25% and the Fed eventually cutting in December, according to BofA strategists. Stocks will move sideways and the S&P 500 (SP500) (NYSEARCA:SPY) will end 2023 at 4,000, Michael Hartnett and team wrote in a note. "We stay bearish risk assets in H1, likely turn bullish H2," Hartnett said. "We are long US government bonds in H1" with "hard landing & credit event risks underpriced," Hartnett added, maintaining optimal S&P entry points of "nibble" at 3,600, "bite" at 3,300, and "gorge" at 3,000. Here are their top 10 trades for 2023:

- Long 30-year Treasury (US30Y) (TBT) (TLT) "on recession, unemployment, Fed cuts late’23, history (US Treasury returns have never fallen for 3 consecutive years)."

- Yield curve steepeners "as US yield curve always steepens as recession begins and markets anticipate Fed flipping from hikes to cuts."

- Short U.S. dollar (USDOLLAR) (DXY) (UDN), long emerging markets assets (EEM) (SPEM) (FEM), long EM distressed bonds, long Korean won on China reopening, long Mexican peso on "nearshoring."

- Long China stocks (MCHI) (FXI) as "COVID reopening was v bullish for US/EAFE stocks, China has high 'excess savings' and China stocks remain v contrarian long trade."

- Long gold (XAUUSD:CUR) (GLD) (IAU), long copper (HG1:COM) (COPX) on "US$ peak, China reopening, metal inventory shortages, energy transition acceleration, need in 2020s for inflation hedges."

- Barbell credit with "long credit too consensus in ’23, we barbell long IG tech bonds (>5% yield + strong balance sheets) with distressed HY debt in Asia (17% yield)."

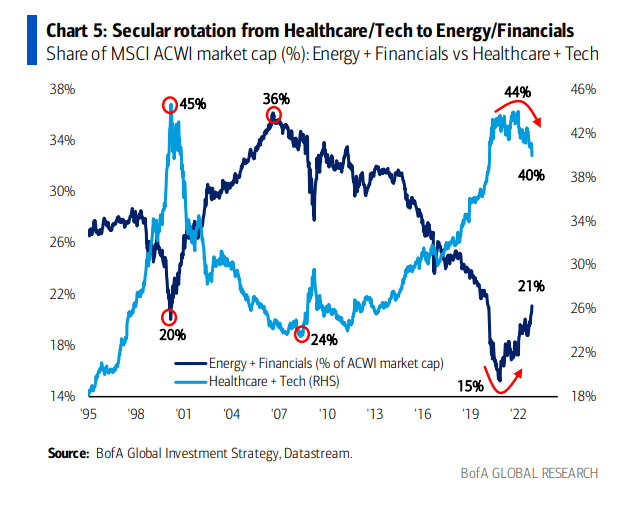

- Long global industrials (XLI) and small caps (IWM) on "secular leadership shift in 2020s from deflation to inflation assets, driven by globalization to localization, monetary to fiscal excess, inequality to inclusion and so on just beginning; capex set to be new macro bull story."

- Short U.S. tech (XLK) (XLC). The "old leadership, still over-owned, era of QE is no longer, era of globalization no longer, plus peak penetration and regulation risks."

- Short private equity (PSP) with "redemption risks given shadow banking exposures to housing & credit risks."

- Long EU banks, short Canadian, Australian, New Zealand and Swedish banks. "EU fiscal stimulus to wean Eurozone off Russian energy dependence, Chinese export dependence, US military dependence vs real estate market busts in Canada/Australia/NZ/Sweden."

0 comments